Anthropic's $183B Valuation: What Enterprise Claude Users Need to Know

Analysis of how Anthropic's massive funding round and international expansion will impact Claude API users, pricing, and feature development through 2026

Executive Summary

Anthropic's meteoric rise from startup to $183B valuation isn't merely a Silicon Valley success story, it's a pivotal moment for every enterprise relying on Claude. With a current revenue run rate of $5B and pressure to reach $20B by FY26, Anthropic is rapidly evolving from an AI research lab into a global AI infrastructure provider. The appointment of former Google Cloud executives to lead EMEA and Japan operations signals more than geographic expansion, it hints at a fundamental shift in how Claude will be packaged, priced, and deployed globally. Enterprise users should expect regional pricing variations, feature availability differences, and potentially even model performance disparities as Anthropic chases the hyperscaler playbook to justify its astronomical valuation.

The Transformation

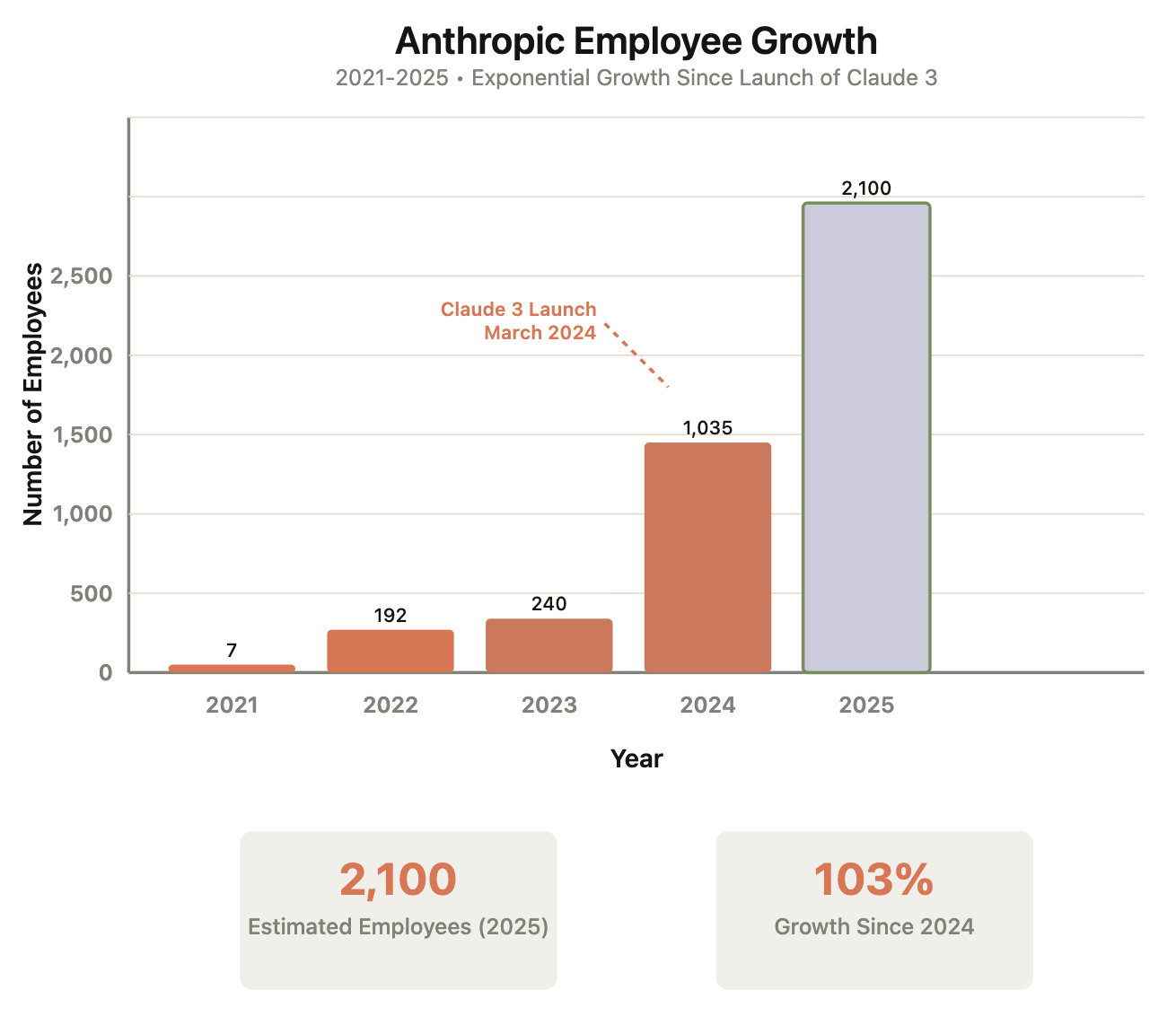

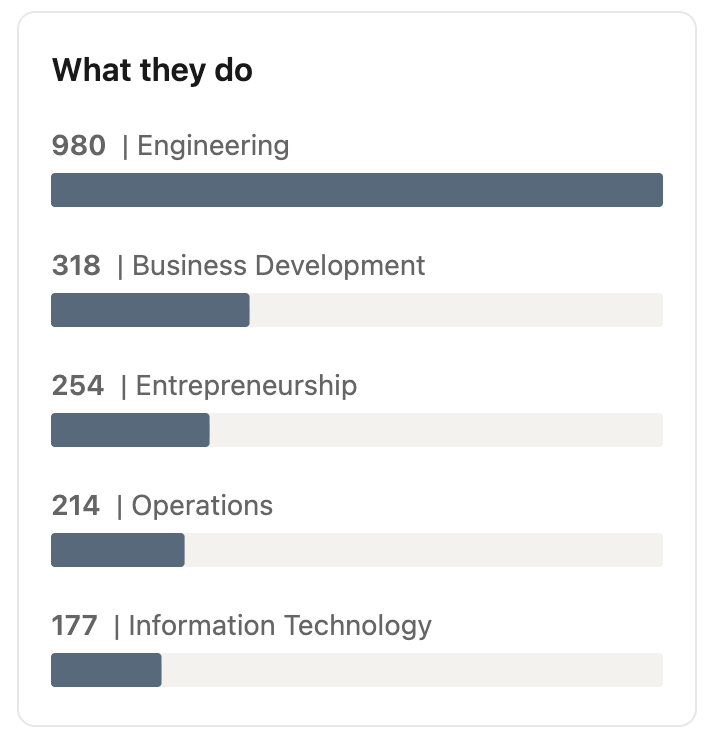

Anthropic is not a startup anymore. This might seem like an obvious statement on the heels of Anthropic raising $13B at a staggering $183B post-money valuation, however it wasn't so long ago that Anthropic truly was a startup. Back in March 2024, when Claude 3 launched, Anthropic was less than 500 people and the employee mix was mostly engineers working on Claude. Anthropic's go-to-market team was less than 25 people with Kate Jensen as their head of sales and the majority of their team was mostly based in their New York or San Francisco office. Fast forward to end of 2025 and we see Anthropic's headcount has doubled year over year.

While the company continues to be an AI research lab with a strong engineering focus with at least 50% of the staff focused on building Claude, they are going to have to scale their sales team rapidly to meet expectations of their latest round of investment.

But what does this transformation mean for enterprises relying on Claude? As Anthropic scales from startup to potential trillion-dollar company, Claude's API availability, feature roadmap, and enterprise support are going to evolve quickly, and the first steps are going to be in expanding localized support of their customer facing teams.

International Expansion and Claude API Availability

Anthropic's recent Economic Index report found that nearly 80 percent of consumer Claude usage comes from outside the United States while Anthropic's global customer base has grown from under 1,000 business customers two years ago to over 300,000 today - representing more than 300x growth. It's no surprise then that Anthropic is sending out a clear signal that they are scaling up their international presence with the appointment of Guillaume Princen as Head of EMEA in April, Hidetoshi Tojo as Head of Japan in August and in September Chris Ciauri as Managing Director of International.

It's notable that Chris Ciauri was previously head of Google Cloud's EMEA and Hidetoshi Tojo was previously head of sales for Google Cloud Japan, since Google Vertex is one of the two official third party API providers for Claude. This geographic expansion has direct implications for Claude enterprise users. Currently there is no region selection for the Claude API accessed through Anthropic's Claude Developer Platform. Having Claude served from a specific region is only available via Amazon Bedrock or Google's Vertex AI Platform. Highly regulated customers (financial services, healthcare, public sector) are going to require that Claude model inference stays inside their region. This will become a pillar of Anthropic's growth and we should expect availability of the latest version of Claude, lifecycle across model families and versions, feature availability and pricing to become distinct within regions.

Selling the Vision of a $2T Unicorn

With the company valued at $183B and a current run-rate of $5B, Anthropic is trading at 36.6x revenue, abnormally high, even for a fast-growing SaaS company. Most enterprise software companies trade at 10-20x revenue. VCs typically expect a 5-10x return, to meet these expectations Anthropic would need to reach $900B-$1.8T market capitalization and join the exclusive club of the 12 most valuable companies in the world, in record time.

To justify these valuations, Anthropic will need to dramatically increase Claude's revenue. This could mean:

- Premium enterprise tiers such as the Claude Code Premium seats

- Usage-based / feature-based / use-case-based pricing changes - such as charging for interpretability or model steering

- Experimenting with new model tiers

- Launching vertical specific Claude products like Claude for Education and Claude Financial Analysis Solution

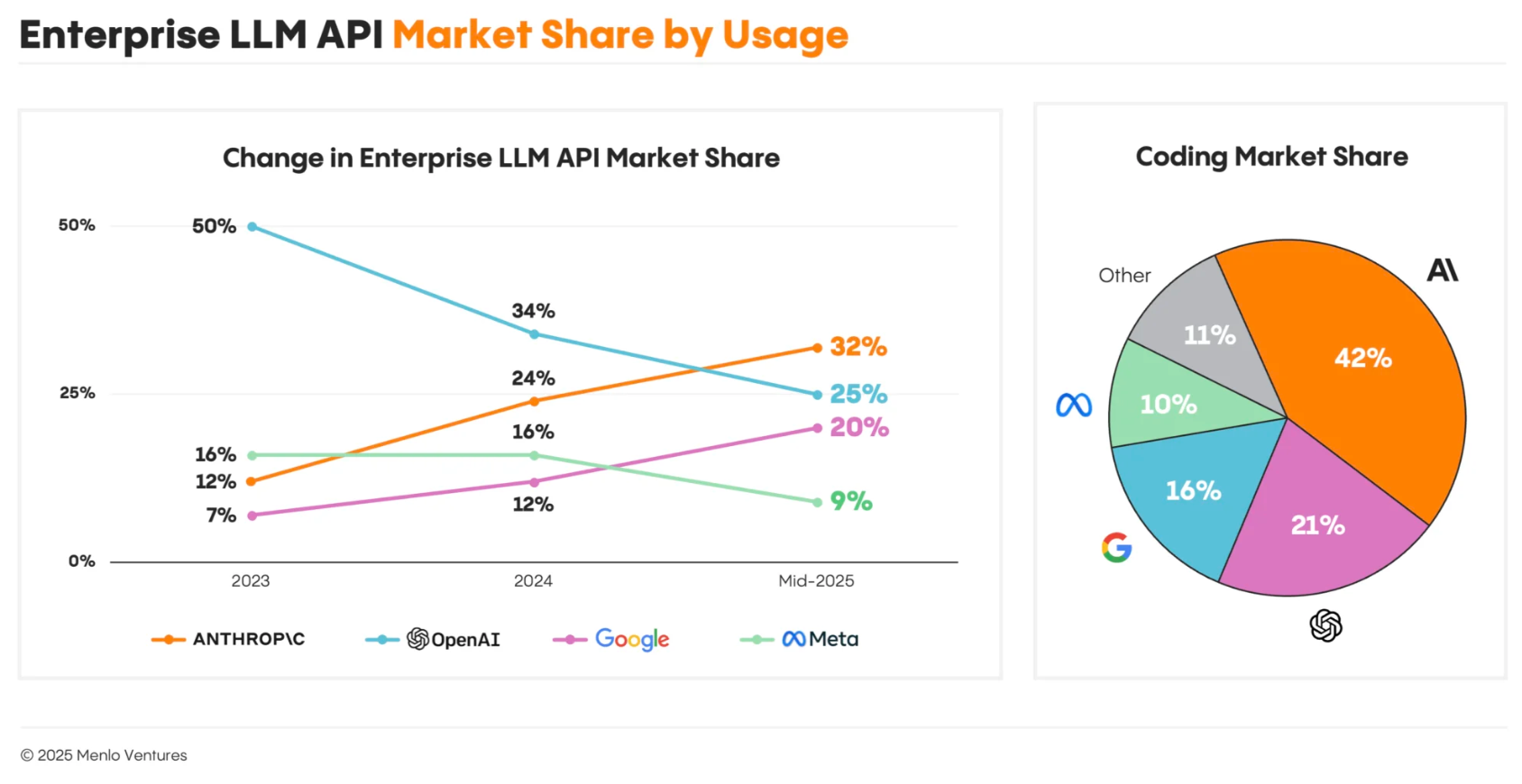

Given these growth targets, it's not surprising then that we see Anthropic's marketing team proclaiming that "Anthropic has the top market share in enterprise AI spend (32%)" based on a report from Menlo Ventures published July 2025.

The accuracy of this report warrants scrutiny. Menlo has a vested interest in this narrative as they have participated in Anthropic's Series C in May 2023, led Anthropic's Series D in January 2024 and tripled down on Anthropic's Series E in March 2025 as well as financed the Anthology fund, a $100M initiative to support startups innovating broadly with Anthropic technology. Their report states:

This report summarizes data from a survey of 150 technical decision-makers at enterprises and startups building AI applications, conducted from June 30 to July 10, 2025. Enterprises are defined as organizations with 5,000 or more employees. Startups included in the sample have raised at least $5 million in venture funding.

The report is based on a sample of 150 decision-makers which raises questions about statistical significance, particularly given the potential overlap with Menlo's portfolio companies and Anthology fund participants. More reliable indicators of Claude's market position would come from API call volumes, GitHub mentions and implementation patterns, enterprise case studies and third-party benchmarking.

The Hyperscaler Playbook for Claude

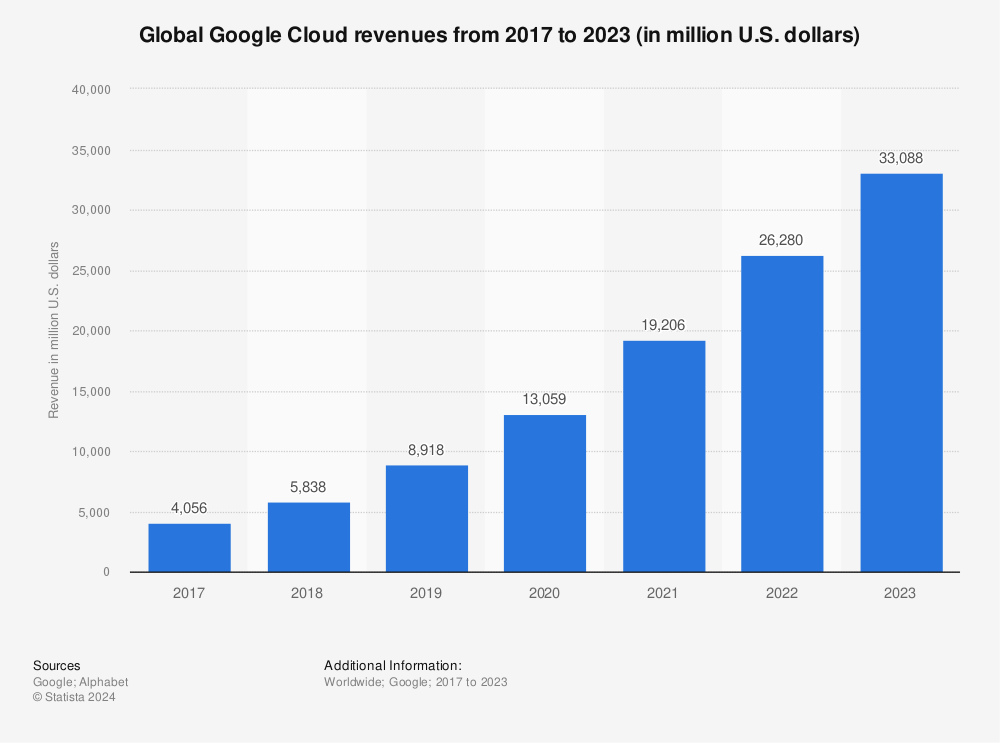

In Q4 2024 AWS segment sales increased 19% year-over-year to $28.8 billion which translates to a $115.2B run rate, while Google Cloud revenues increased 30% to $12.0 billion or a $48B run rate. It took over 10 years for GCP to reach a $5B annualized run rate which it reached in 2018.

Find more statistics at Statista

While Anthropic will be hard pressed to 4x their current run rate over the next 12 months, a $20B run rate is likely the target their new CRO and CFO will set for FY26, because they will need to raise capital again, to train the next version of Claude. Here is a quote from Dario on training run costs:

"I think we're going to see models trained in the next year are going to be about $1 billion," Amodei told the outlet. "And then 2025, 2026, we're going to go to $5 billion or $10 billion. And I think there's a chance it may go beyond that to $100 billion."

This suggests Anthropic needs to reach GCP's 2021 scale within a year - hence the strategic recruitment of former Google Cloud leadership, to fast track connecting within regional executives.

If this pace of growth feels unlikely I recommend reading Julian Schrittwieser's article about how most people fail to understand how exponentials work which ends with the following outlook for the next 2 years:

Models will be able to autonomously work for full days (8 working hours) by mid-2026.At least one model will match the performance of human experts across many industries before the end of 2026.By the end of 2027, models will frequently outperform experts on many tasks.

For enterprises using Claude, these developments suggest a clear trajectory:

- Expect rapid API feature velocity through 2026 as Anthropic chases growth

- Prepare for potential pricing model changes as the company seeks to justify valuations and as training costs escalate

- Consider a multi-provider evaluation strategy (Anthropic direct, Bedrock, Vertex) for quota capacity, redundancy and capabilities

- Watch for regional API differences as international expansion accelerates

The transformation from startup to tech giant won't just change Anthropic, it will reshape how Claude is delivered to enterprises.

The Bottom Line for Claude Users

Immediate Actions for Enterprise Teams:

Start evaluating your Claude implementation strategy now. The unified, simple Claude API of 2024 is evolving into a complex ecosystem with regional variations, tiered pricing, and provider-specific implementations. If you're currently using Claude through only one provider, begin testing alternate channels, particularly if you have international operations or strict data residency requirements.

Key Decisions for 2026 Planning:

- Provider Strategy: Don't assume feature parity across Anthropic direct, AWS Bedrock, and Google Vertex AI. Each will likely develop distinct advantages'; Bedrock for AWS integration, Vertex for Google Cloud services, and Anthropic direct for cutting-edge features.

- Budget Forecasting: Current pricing won't hold. Plan for 20-30% cost increases in Claude spend as Anthropic introduces premium tiers and usage-based pricing for advanced features like interpretability and model steering.

- Contract Negotiations: Lock in enterprise agreements now while Anthropic is still in growth mode. Post-2026 pricing power will shift dramatically if growth targets are met.

The Strategic Question:

The real question isn't whether Claude will remain competitive—with billion-dollar training runs and exponential capability improvements, that's almost certain. The question is whether your organization is prepared for Claude to become as complex and varied as the cloud platforms that host it. The companies that thrive will be those that treat Claude not as a single API, but as an ecosystem requiring the same strategic planning as any other critical infrastructure decision.

This is the first post from The Claude Index, a blog dedicated to deep analysis of Anthropic Claude from an enterprise perspective. Follow for weekly insights on API comparisons, pricing analysis, and strategic guidance for Claude adoption.

This article was co-edited with Claude, demonstrating the collaborative potential of AI in content creation while maintaining human insight and strategic perspective.